Reports Previous Workshops

Fifth Workshop – Tuesday 29 September to Thursday 1 October 2015 in Santpoort, Netherlands

Module 3 – Co-productions: Legal and Financial Issues

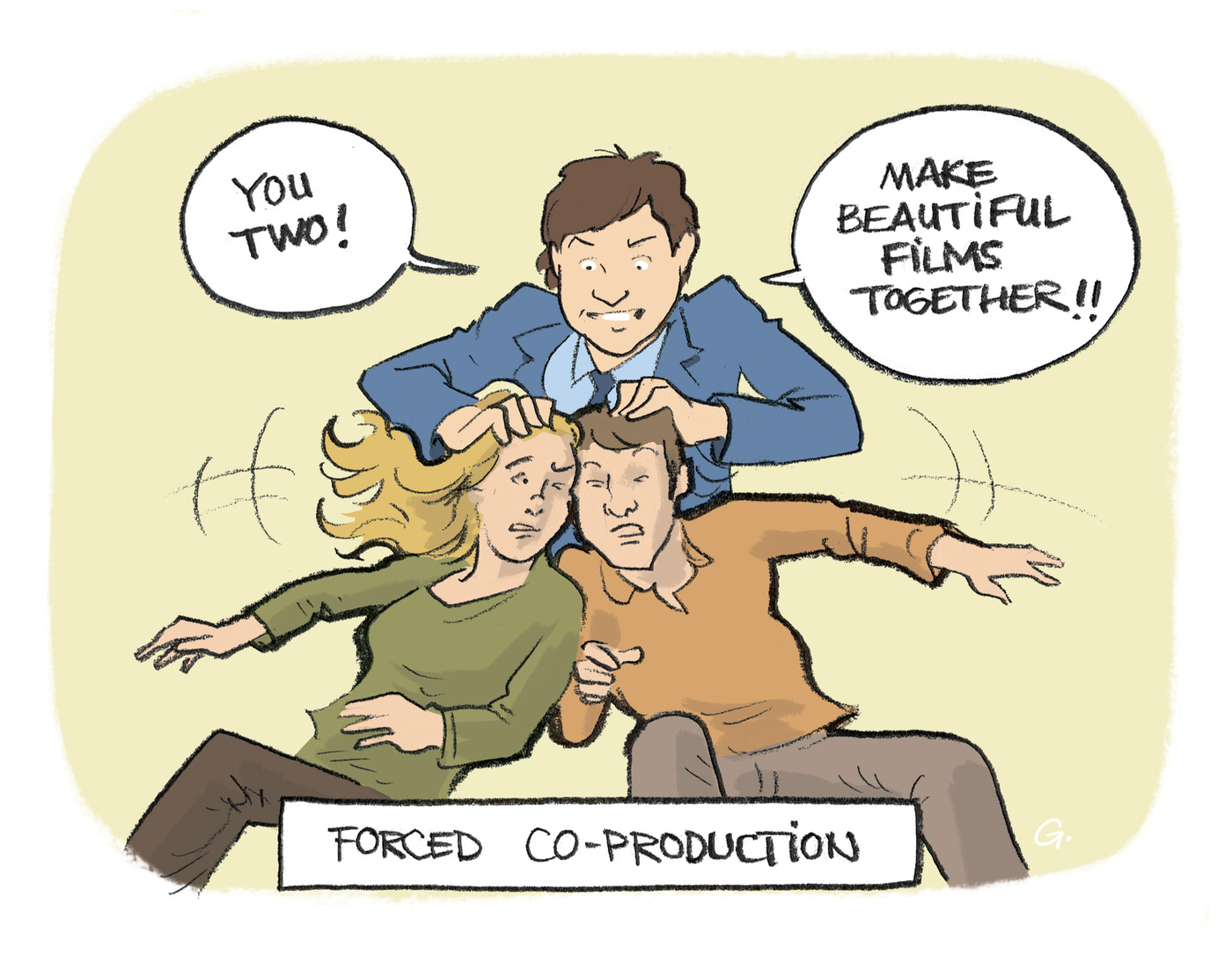

Co-production means putting together different business practices and requirements from all partners (incl. funds, distributors, private funds, etc.). It means, for both producers and funds, a lot of paperwork and sometimes hard negotiations (mainly recoupment).

Or, in other words:

- What are the minimum essential requirements that funds could ask from producers?

- Could the fund that finances the majority producer be the leader in terms of approval?

- Do producers have enough co-production knowledge?

Pierre Emmanuel Mouthuy, lawyer – Belgium

Please also see Pierre Emmanuel Mouthuy’s presentation (PDF)

Financial Issues

1. Set-up of co-productions

Co-productions can be set up in three different ways when it comes to financing:

- Co-production treaties are rigid and necessitate creative contributions from the producers. Minimum participation is usually 20%.

- Financial co-productions with exclusively financial contributions. Minimum participation is usually 10%.

- Co-productions entirely financed by sales agents are commissioned and always made with low risk since sales agents invest their own money.

➔ What is important for funds to validate and check before closing the financing?

- Producer(s) and co-producer(s) responsibilities.

- Responsibilities of the co-producers in terms of financing.

- How do co-producers re-distribute responsibility among themselves?

- Sometimes co-producers from other countries demand co-production agreements at a very early stage.

2. Cash-flow issues

Once the financing is closed, the cash-flow issues appear. Producers get the money from different funds and other sources but how do they cash flow them?

- Cash flow facilities don’t exist in most of countries; banks are reluctant.

- Bad cash flow could either cause everything to collapse or the project simply does not get any money and the minority co-producer is out.

- Producers tend to end up financing one project with the money from another, which leads to legal conflicts.

- No payments are made in advance. Even if public funds cash-flow their participation during production, the “market money” (TV presales, equity money, distribution MGs) is mostly paid upon delivery.

➔ The ways to overcome cash-flow issues:

- Coficiné and Cofiloisir: as financial institutions (not banks), they are specialised in cash flowing audiovisual projects without taking away any rights from a project. Based in Paris, the two companies used to work only with French producers but have started to be more and more involved in co-productions, even without a French producer.

- Collection agreement: Eurimages requires a collection agreement for films with budgets of over 3 million Euros. However, legally speaking, it covers only the allocation of the revenues among the financial partners.

- European guarantee funds: in place since almost 2 years, has only been successful in a couple of European countries.

- Completion bonds: mostly in the Anglo-Saxon world (UK, Ireland, Canada, USA). It guarantees the delivery of the film but is too expensive for continental European countries, since it takes 5 – 10% of a budget.

- Escrow is the account where money stays until all the contracts are signed. It involves an escrow lawyer, escrow guarantor and enables everybody to take a look into each other’s payments. However, it is practiced only in the Anglo-Saxon world, almost never in continental Europe.

- Interparty agreement (IPA) is an agreement between funders, producers, sales-agents and completion bonders. Such agreements exist if a completion bond is involved. IPA ensures that everybody speaks with each other. It, legally speaking, may help resolve a lot of issues regarding cash flow, sales agents, MGs, waterfall, etc. Such agreements define clearly everybody’s duties and track down more easily the ones who break it.

- Specific purpose companies (SPV) per film: is required by some of the public funds or tax incentives in order to decrease the threat that the money will go to other projects within the same company.

Legal Issues

Securing financing for co-productions implies no real legal issues since it is easier to go bankrupt than to end up in court. It is mostly business issues that you need to translate into legal terms to protect and balance the responsibilities of both the minority and majority co-producer:

- The minority co-producer wants to be certain that if he/she finds the money, he/she stays attached to the project. The minority co-producer can demand that the majority producer takes care of any overspend and shortfalls.

- The majority co-producer wants to keep the freedom to make changes to the project. He/she will have the final say on cast and the number of shooting days, but will also bear responsibility when it comes to financing and legal matters. Sometimes, at a later stage, he/she can become a minority producer if he/she does not secure enough funding, but often stays as delegate producer.

Legally speaking, every co-production needs to have a delegate producer as the leader.

Compliance with public funds requirements

- Funds require that local producers provide co-production agreements, deal-memos or a strong letter of commitment when applying for funding. This particularly applies to tax-credits and minority co-productions.

- Funds could be more engaged in pointing out to producers non-reliable partners.

- Many funds do not have minority schemes and thus prevent many potential creative and organic co-productions.

- Every fund covers their own region, checks their projects from their own side, and relies on the partnership from abroad. But maybe it should be demanded that they survey the entire co-production.

- Funds are politically-oriented sometimes and block certain co-productions in order to comply with the demands of politicians.

- The funds should be involved in Interparty Agreements, especially for films with budgets of over 3 million Euros that include completion bonds and complex financing.

Outcome of the group discussions

Recoupment position of public funds

Swedish Film Institute

They have a very soft recoupment scheme recouping under 125%, but hardly ever reaching that. Generally speaking, they are short of people who would deal with recoupment and collect recoupment money. They choose the films that are expected to earn some money and assign collecting agents only to them.

Norwegian Film Institute

They have a revolving system. They give the recouped money to producers for their next films. This applies to majority co-productions and national films.

Luxembourg Film Fund

They are the first within the recoupment scheme. The recouped money is transferred to the producer’s account for the development or production of his/her next project supported by the Luxemburg Film Fund. It is a way to strength their producers’ position towards other financiers and partners.

Irish Film Board

They invite producers to negotiate the recoupment schemes with them because producers know that most of the recouped money will eventually come back to them.

Wallonia Brussels Federation

Their fund recoups on 50%. Some funds, like the Belgian regional fund Wallimages, recoup in first position even if private equity investment is involved. Recoupment could be easier if public funds would simply ask for 15% on the net receipts in the first position and also oblige equity investors to stick to it. But, in reality, given that some funds do not recoup and others recoup at different stages, it is up to the funds to be strong in determining their position.

Conflict situations

Croatian Audiovisual Center

Producers encountering a problem with a co-producer expect their funds “to arbitrate”. It can be especially difficult when the national producer is the one who is behaving badly. They currently have a never-ending story with a short animation movie between Italy and Croatia. The Croatians lied to the Italians about the amount they got from the fund, and the Italians found out.

Eurimages

Unfortunately they face legal issues in co-productions and some of them will last forever. Eurimages suspends the funding until the final decision at the court, but with all the appeals the process is never ending. And sometimes the laws are different in co-producing countries. They discourage producers from arbitration.

Luxembourg Film Fund

Once they encountered a cash-flow problem with a project during production. Although Luxembourg is a financial centre, there were no banks that dealt with film financing. The producers eventually resolved the cash-flow issues with the help of Coficine/Cofiloisirs.

Norwegian Film Institute

They receive a lot of project with high budgets, or with complex financing plans, or from companies that are not that strong. Cash-flow problems are never generated by the funds, because funds make advance payments. The problem appears with overspend, because in such cases, it is very difficult for the fund to increase the support. Thus, they require that producers sign special agreements beforehand, undertaking that they would finance overspend.

Conclusions and challenges

- The major issues between co-producers are related to cash-flow. They are almost never legal.

- Very few producers have enough legal knowledge when it comes to co-productions.

- Film funds sign contracts only with local producers. Should they enter Interparty Agreements (IPA) and play a more active role when it comes to minority co-productions?

- Funds could simplify co-producers’ paperwork by harmonising the regulations, procedures and administrative requirements (for instance, using similar production budget templates, having similar requests regarding certified production costs, undertaking joint audits, sharing information or documentation on common projects to save producers from providing the same documents several times, etc.

- Funds mainly stimulate co-productions through incentives, co-production markets, film commissions and co-production treaties.

- Public film funds are positioned very low in the waterfall. If you position the public funds higher within the recoupment scheme, the private investors will not have a choice and will accept it. Recoupment, however, makes sense only if a project is commercial and financed partly with equity funds. For “difficult” arthouse films, it is not important, since they are anyway financed through public money.

International co-productions, Development, Gender and quotas

- Module 1 – Co-production: Landscape (volume, co-production treaties, cinema vs television, financial, non-official)

- Module 2 – Co-productions: Financing issues: for the producers, for the funds (specific programmes, decision timeline, recoupment, financial co-production)

- Module 3 – Co-productions: Legal and Financial Issues

- Module 4 – Distribution: co-production opens access to other countries, does the audience follow?

- Module 5 – Gender / Quotas Issue – Update on Funds’ Strategies

- Module 6 – What to foresee in the next ten years based on what’s going on now?

- Module 7 – Development – An underestimated stage in the production process?

Illustrations by Gijs van der Lelij

Schedules Previous Workshops Partners Contact