Reports Previous Workshops

Fifth Workshop – Tuesday 29 September to Thursday 1 October 2015 in Santpoort, Netherlands

Module 4 – Distribution: co-production opens access to other countries, does the audience follow?

Co-production treaties allow projects to have different nationalities and to access public funds in each country including distribution subsidies.

Or, in other words:

- What are the audience results for projects in their co-production countries?

- At what stage of production is a local distributor required?

- For which market?

- Given the difficulty of accessing audiences for national films, how are co-produced films promoted and released?

- How to attract an audience?

- Could other distribution platforms be allowed in this context?

The circulation of European co-productions

Martin Kanzler, Analyst – European Audiovisual Observatory

Please also see Martin Kanzler, European Audiovisual Observatory (PDF)

Note: the nature of the figures in the presentation is PROVISIONAL. This presentation is confidential and cannot be published or communicated until the publication of the final analysis results in a report scheduled to be published in early 2016.

Comparison between national films and co-productions

Do co-productions circulate better than national films?

➔ the response is clearly YES

Four circulation indicators

- Export ratio

- Average release markets

- Average admissions

- Weight of non-national admissions (the importance of export markets)

Data Sample

- Cumulative admissions for:

- European (majority) from countries with fairly comprehensive market coverage.

- Feature films (fiction and documentaries).

- Produced and released in the time period 2010-2014.

- On 39 markets worldwide (27 European markets and 12 non-European markets).

- The European Audiovisual Observatory’s definition of co-production implies every production whose financing comes from more than one country. It does not only refer to treaty co-productions.

- Non-national releases include any country outside the country of the majority co-producer.

- They look at cumulative admissions for the European films as registered in the Lumiere database.

- The data for the non-European markets are gathered through co-operation between many European national funds. They purchased data from Rentrak for the non-European countries included in the analysis (Canada, 4-5 Latin American markets, China, South Korea, Australia and New Zealand).

- The total sample of analysed films in the study involves 7300 titles. Out of this number 3200 films responded to the criteria and can be considered as “exported films”.

- Out of the 3200 films, 2900 films had non-national releases in Europe and 1200 films had a release outside of Europe.

Circulation Indicators’ Analysis

1. Export ratio by production type

- The export multiple for co-productions is twice as high as for national films. 71% of co-productions had a release outside the home market, while it is the case with only 35% of national films.

- The export ratio of films with non-national releases in Europe is 66% (when it comes to co-productions) – 32% (when it comes to national films).

- The export ratio of films with releases outside Europe is 11% (national films) -34% (co-productions).

➔ Conclusions

- Almost 3 out of 4 co-productions are released on a non-national market as compared to about 1 out of 3 national films.

- Co-production “export multiple” is x 2.0.

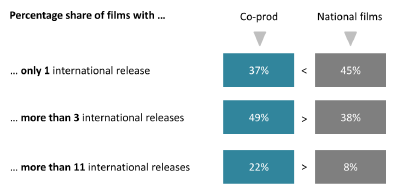

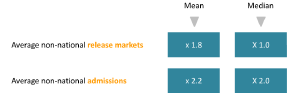

2. Average number of non-national release markets

- Co-productions on average get released on 7 non-national markets, whereas national films get only released on 4.

- The majority of films get released on only a few non-national markets.

- The average number of non-national release markets in Europe is 5.7 for co-productions and 3.4 for national films.

- The average number of non-national release markets outside of Europe is 3.2 for co-productions and 2.3 for national films.

- 58% percent of national films released in non-national markets are released in Europe and 42% outside Europe. When it comes to co-productions, that ratio is 51% – 49%.

➔ Conclusions

- Co-productions are released on almost twice as many non-national markets as national films. The co-production release multiple is 1.8.

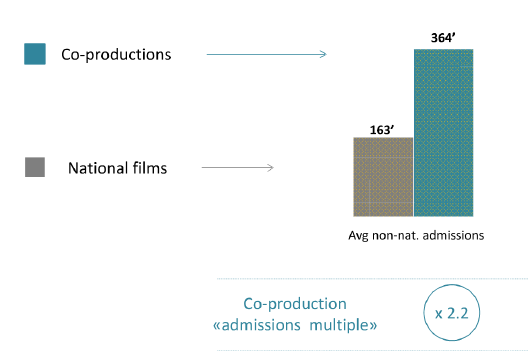

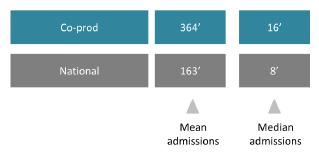

3. Average number of admissions per film

- This is a good example how limited the explanatory power of average values can be in a data sample with wide variance:

➔ Conclusions:

- On average, admissions per film are more than twice as high for co-productions as for national film.

- The exact co-production admissions multiple is 2.2.

4. Percentage share of non-national admissions

- Co-productions generated 63% of the admissions in non-national markets.

- National films generated 26% of those admissions.

Split of non-national admissions: Europe vs outside of Europe

- Co-productions generated 49 % of outside of EU admissions (vs 51% in EU).

- National films generated 42% (vs 58% in EU).

➔ Conclusions:

- Theatrical exploitation of non-national markets is more than twice as important for co-productions as it is for national films.

- Co-production “export dependency multiple” is 2.5.

5. To summarise:

- The share of co-productions to get exported is twice as high as national films.

- On average, they get released on almost twice as many non-national release markets.

- And generate more than twice as many non-national admissions.

Methodological constrains and challenges

- All the above information is based on the Lumière database collected from national funds. A number of false allocations can emerge on the way but, given the large sample size, the comparative conclusions are valid.

- The definition of “national market”:

- Only the majority producer’s country (as used in this presentation)?

- Or all co-production countries involved in a project?

- In both cases the indication is that co-productions circulate better outside of the co-production markets than national films. The percentage would be slightly lower but, according to all indicators, the performance of co-productions will still be better than the performance of national films.

- The definition of “European film”:

- Can UK films produced with capital from the US be considered as European films? In Britain, the British Film Council perceives them as European, unlike continental Europe. The EAO excludes films without majority European financing or those which are not considered as European by the MEDIA Programme or Europa Cinemas (i.e. if they do not qualify for their distribution support), or according to the definition of the European Commission.

- The definition of a “co-production”:

- EOA analysis is not limited to “official co-productions” made under the treaties.

- There is a big question which stays unclear: what would be the results if we counted only them? So far EAO doesn’t have the resources. There is the possibility of introducing, into the Lumière database, a marker for official co-productions to be filled out by the funds when they submit the required lists of co-productions.

- The definition of a “correct average”: mean vs median

- Median values complement the analysis but do not change the overall picture

- Figures are pretty clear:

When analysed in large samples, co-productions clearly circulate better – on average – than national films.

- Median values complement the analysis but do not change the overall picture

➔ Roughly speaking twice as well.

But

- Main issue in interpreting: causality!

- Do “co-productions” travel better or “films produced as co-productions” travel better?

- Why are the figures what they are?

- Which conclusions can one draw with respect to shaping funding/film policies?

- Are there any universal characteristics that can have a positive effect on exportability of a film?

Some input

EAO analysed the top 100 films released non-nationally in Europe and the top 100 films released non-nationally outside of Europe between 2010 and 2014 to see if those two groups of successful films have something in common. They completed their data with some from IMDB. Despite the fact there is no formula that can help a film penetrate the international market, they tried to analyse the following aspects that could possibly contribute:

Production type:

- 64% internationally released films outside of Europe are co-productions

- 36% are co-produced with a non-European minority partner

- 28% are “intra-European” co-productions

Genre

- Comedies: 48 films released in Europe while only 16 released outside of Europe

- Drama: the ratio is 19 – 31,

- Thriller: in case of thrillers/action, the ratio is 12 – 26

Language

- 44% are multi-language films

- 56% are single language films

- 71% have English spoken as the main language (31% are UK films), 9% in Spanish, 7% in French and 13% in other languages

Location (as a proxy for local content)

- 29% are shot outside Europe

Budget (as a proxy for production value and possibly expensive crews)

- Only 3 films had a budget below 3 million USD

- The median budget of the 100 films was 13.4 million Euros, which is significantly above the European average

- Median budget of French films was 2.8 million Euros

Sales agents (according to IMDB)

- 67 films released outside of Europe had sales agents

- Only 38 released internationally within Europe had sales agents

Award

- 77 released outside of Europe won at least one festival award

Outcome of group discussions

The study still does not address the following:

- There are some high content co-productions, like creative documentaries, that cannot be classified. Do they travel?

- Is there any difference in circulation of male-directed and female-directed films?

- What is the ratio between the official co-productions and co-productions in general (based on co-financing)? It would reveal the performance of co-production treaties and how rigid they are in comparison with a more flexible way of co-producing.

- There are examples of French-speaking films that are released only in Geneva. They just bring one copy and stay in Geneva for one week. Can this really be considered as an international release?

- Co-productions have much higher budgets and it increases their quality, production value and, consequently, the audiences. In order to secure such high financing, there is a real challenge for producers to attract sales agents, pre-sell the film to many territories and secure many sellable elements in the story before completing the financing.

- Distribution should also focus on VoD releases. The funds should support the possibility that VoD release can achieve the same status as theatrical release. The EAO has a project to collect the catalogues of all VoD service providers in Europe and to link it to Lumière database, in order to see how many countries have VoD releases of particular films.

- National funds must be open toward international co-productions because the local, national audiences are too small. It would also help in convincing the politicians why it is important to finance internationally acclaimed films and launch a separate minority co-production scheme.

- Funds should be constantly collecting and processing data and contribute more actively to the projects of the EAO.

- Sometimes a national film is national for a good reason.

International Coproductions, Development, Gender and quotas

- Module 1 – Co-production: Landscape (volume, co-production treaties, cinema vs television, financial, non-official)

- Module 2 – Co-productions: Financing issues: for the producers, for the funds (specific programmes, decision timeline, recoupment, financial coproduction)

- Module 3 – Co-productions: Legal and Financial Issues

- Module 4 – Distribution: co-production opens access to other countries, does the audience follow?

- Module 5 – Gender / Quotas Issue – Update on Funds’ Strategies

- Module 6 – What to foresee in the next ten years based on what’s going on now?

- Module 7 – Development – An underestimated stage in the production process?

Illustrations by Gijs van der Lelij

Schedules Previous Workshops Partners Contact